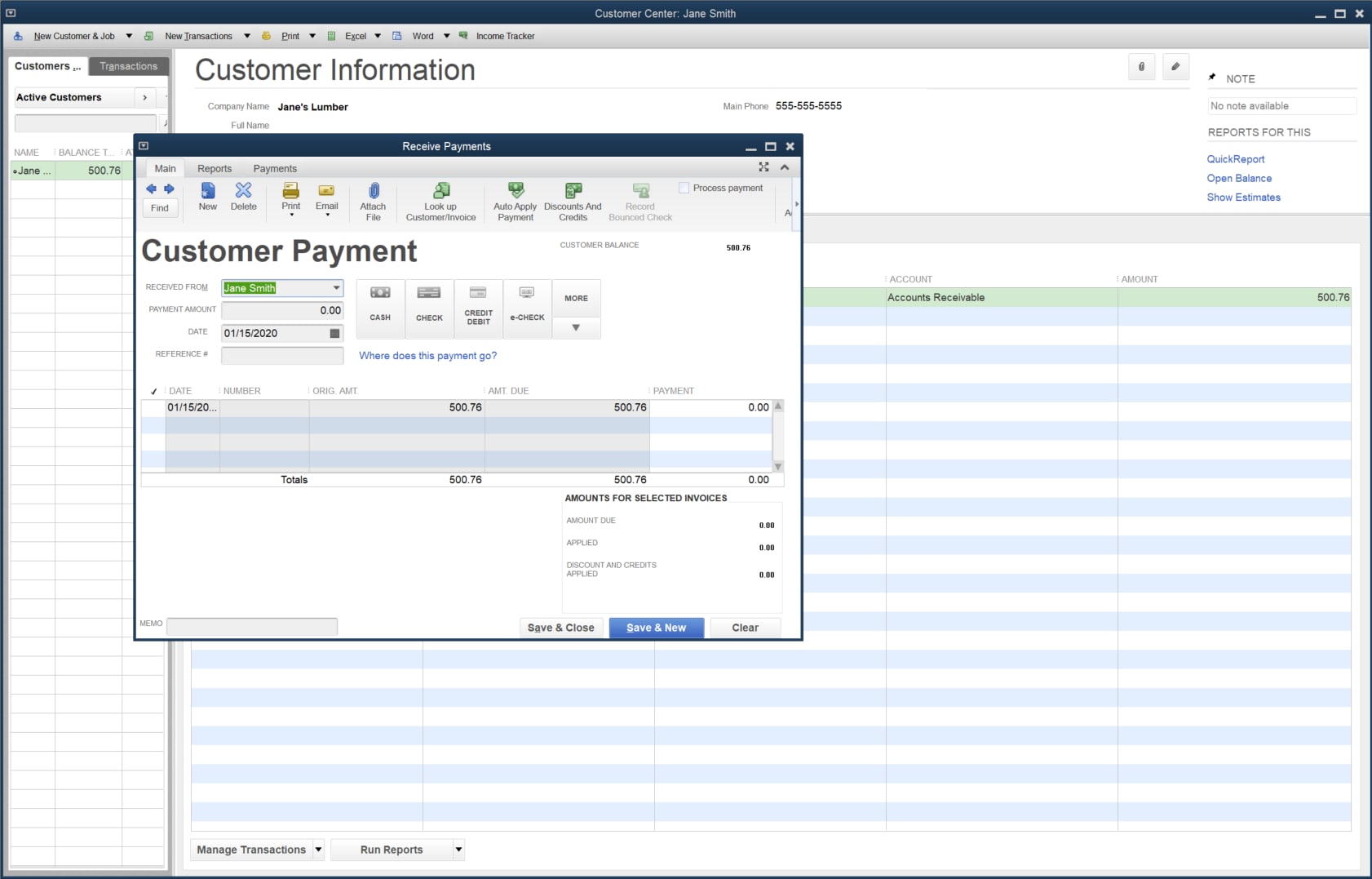

Enter the amount of the advance payment that is now revenue.Select the operating bank account from the Transfer Funds To drop-down menu.Select the trust liability account you created in Step 2 from the Transfer Funds From drop-down menu.Step 4: Transfer advance payments to income Create new transfer by selecting New, then Transfer.Enter the payment amount received in the Rate or Amount column.Select the product/service item you just set up in the Product/Service column.Select the client’s name from the drop-down list.Step 3: Create an invoice for the advance payment -you can also create a cash memo insteadSelect Invoice.Select Trust Liability Account from the Income account drop-down menu.

Select Trust Accounts – Liabilities from the drop-down menu.Select New, Account Type, then Current Liabilities from the drop-down menu.Step 1: Credit the liability account Add a new entry to Chart of Accounts.When using QuickBooks Online for an advance payment from a client, here are the steps you should follow: This may be a valuable part of client relationship building. You may even choose to start with billing in arrears for the first payment, then switch over to advance payment for future projects. Typically, advance billing is better suited for recurring clients with repetitive projects, while billing in arrears is better for one-off projects that may change. When deciding which billing method is best, consider these differences and the type of services you’re providing. With billing in arrears, refunds are much rarer because you don’t receive payment until completion.This can be the case when a client cancels a job before it’s completed or when it’s completed for less than the original quote. With advance billing, you run a higher risk of having to issue a refund.However, you can include the total for everything involved with the project on a single invoice, even if changes occur. In some cases, these unpaid invoices may fall through the cracks. With billing in the arrears, you run the risk of having to continuously follow up with clients for payment.However, if additional work or materials are needed, you’ll have to charge the customer on a separate invoice, meaning you won’t get paid until later. With advance billing, you don’t have to worry about following up for payment.However, you also have to put trust in clients to pay their bill. In this way, billing in arrears is an easier way to build trust with your clients. With billing in arrears, you can prove the quality of your work before requiring payment.However, some customers are not comfortable paying upfront when they haven’t seen the finished product. By billing in advance, you have startup capital to use toward the project.Let’s take a closer look at the differences between advance billing and billing in arrears: Each billing method has its own advantages and disadvantages.

PROGRESS BILLING IN QUICKBOOKS DESKTOP HOW TO

PROGRESS BILLING IN QUICKBOOKS DESKTOP FULL

However, if you are going to accept advance payments, you’ll need to account for these deposits or full payments correctly. Instead, you could choose to require advance payments for your goods and services, or just for certain projects.Īdvance payments are a way to reduce your risk and ensure you have the working capital you need upfront. While this is the way things are often done in business, that doesn’t mean there isn’t another option. One of the biggest risks businesses take is providing goods and services without payment.

0 kommentar(er)

0 kommentar(er)